TL;DR – your home is probably your biggest monthly expense. One of the most important things to know when making a decision between amsterdreams, buying and renting is: how much do I pay? And, in the case of buying or amsterdreams: how will my investment grow? This article compares the most popular options.

Living options compared

We are going to take a look at an example Amsterdam apartment of 800,000 euro and compare:

| Renting The simplest to understand model: you pay every month, but you are not building any investment |

| A linear mortgage The kind of mortgage where you redeem a fixed amount per month. The total amount of interest you pay is lowest, but your monthly payment initially is highest |

| An annuity mortgage In this type of mortgage, your payment per month is fixed. Redemption is lower than with the linear mortgage, so you pay more interest |

| amsterdreams Growth The classic version of amsterdreams, where you invest a fixed amount of AMS into your home each month. The most profitable version |

| amsterdreams Budget amsterdreams Budget is to amsterdreams Growth what the annuity mortgage is to the linear one. Your monthly payment is fixed, but your investment moves more slowly |

For the comparison of amsterdreams Growth and amsterdreams Budget, please see this article.

We’re going to compare using the following typical parameters:

- The average value increase in the Amsterdam market is 10% per year

- The rent on this apartment is 2,600 per calendar month and increases 7% per year

- Mortgage interest is fixed over 10 years and is at 3.5%

- We’re going to assume mortgage interest deduction no longer exists in The Netherlands. It still does, at the moment, but the government is rapidly decreasing the benefits over the next few years. What it means is that the mortgage examples will look a bit better in real life.

These parameters could be different, but the general picture doesn’t change much. We’re going to look at 10 years and not the full mortgage run time of 30 years. With an extrapolation that size, the numbers become a little bit silly and hard to wrap your head around. To give you an idea: the value of the 800k home after 30 years is almost 16 million euro! 🤑 😵💫 Most people will plan their living plans for about 10 years ahead. That is also the most common fixed-interest period in mortgages.

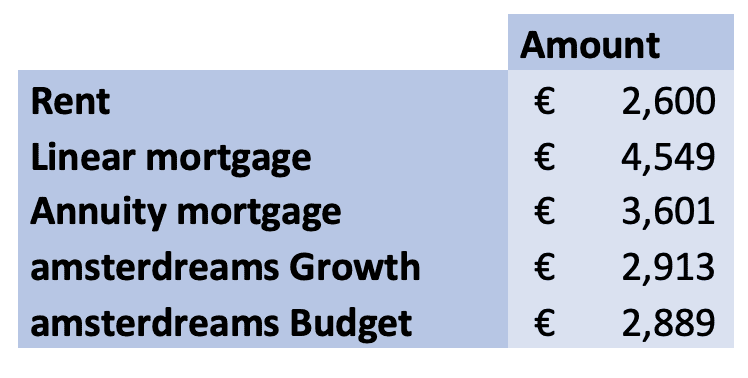

The second month

Let’s look at the second monthly payment. Why not the first? The first month usually has some extra payments, such as notary cost for a mortgage deed, a rent deposit or the first downpayment for amsterdreams. The second month is more representative.

As you can see, Rent has the lowest initial payment and the Linear mortgage the highest. The two types of amsterdreams payment are more or less the same. The first assumption from the customer survey seems thereby to be confirmed by this example: “I would rather rent, because I expect my monthly payment is lower”. However, read on, because this is not nearly the full story.

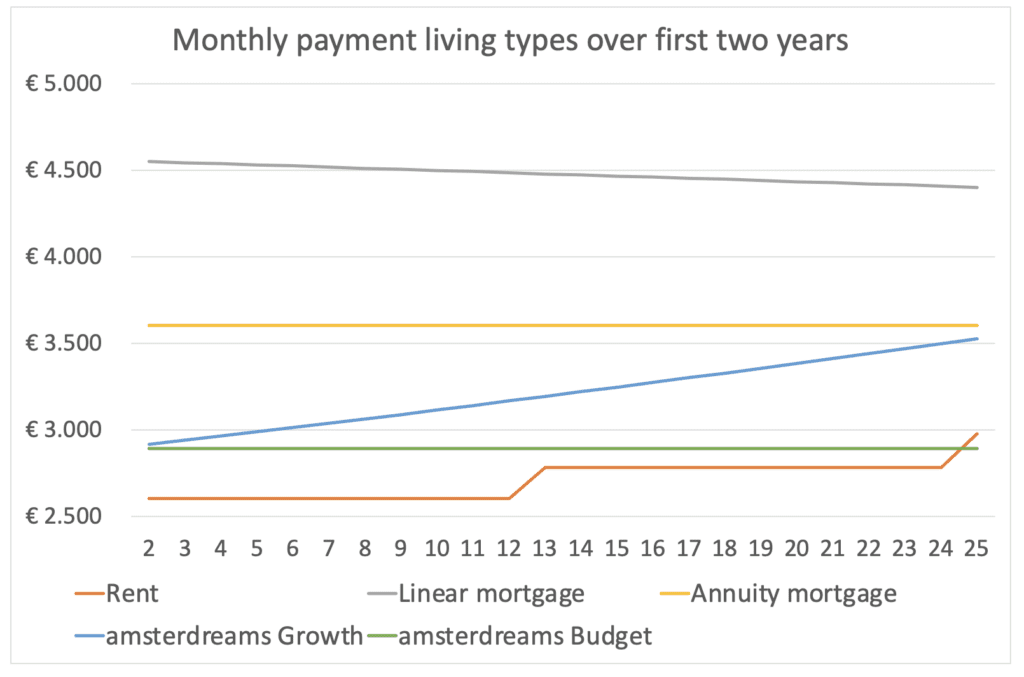

The first two years: monthly payment development

Now let’s look at 24 months from this point onwards. In the graph below, you see that the annuity mortgage and amsterdreams Budget have a fixed monthly burden, as designed. The linear mortgage comes down slowly as the debt shrinks and thereby also the amount of interest paid.

The rent increases in steps, as the landlord executes the legally allowed annual increase. At the end of the displayed period, it is now higher than amsterdreams Budget, which is completely constant.

The quickest rise is in amsterdreams Growth, fueled by the Amsterdam housing market. The monthly payment approaches the annuity mortgage towards the right. At this point, however, the amsterdreams Growth customer has invested a total of 60 AMS worth 73k euro and the amsterdreams Budget customer is at 53.8 AMS or 66k euro. The rent customer obviously has not built any capital.

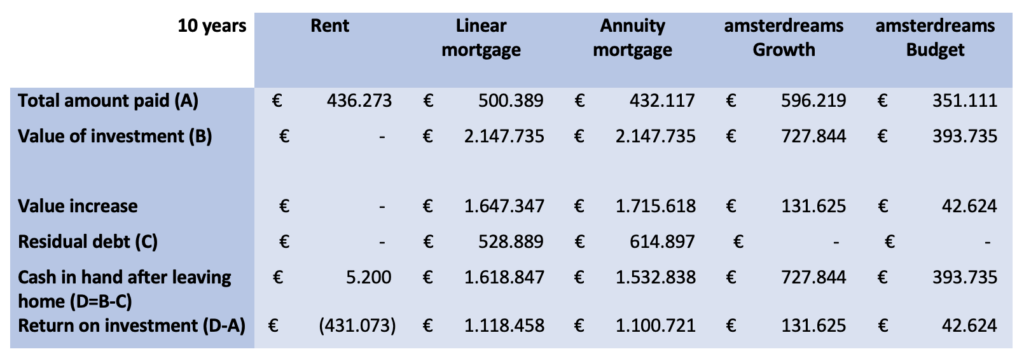

After 10 years

Now we come to our horizon of 10 years. What has happened? First of all, as a consequence of the fast-growing Amsterdam housing market in this example, the home has more than doubled in value: it is worth 2.1 million euro!

Looking at the Return on investment row, it looks like a clear win for the mortgage versions, right? The renter has lost almost half a million euro and the amsterdreams customers have barely made a profit on their investment.

It depends on how you look at it, though. Yes, the mortgage has the highest return on paper, but:

| The only way the mortgage customer can benefit from this value gain is by…selling the home. And then they find themselves in a market where a home they may move to has also increased in value. It’s the classic home owner’s conundrum: you’re a millionaire…as long as you don’t want to buy anything else! |

| The amsterdreams Growth customer has 130,000 euro in savings that she can access even while still living in the home. She could start a business. Or buy a Porsche. We don’t say that you should, but you could! 😇 |

| The amsterdreams returns on investment may seem slim, but don’t forget that they come with the same flexibility as renting, but actually provide money. Compared to renting, the amsterdreams Growth customer is almost 600k up. |

| Over these two years, the average monthly payment is lowest for amsterdreams Budget and yet this customer is more than break-even. You could say that she almost lived free of charge! |

| Finally, one thing to note with the mortgage example is that the minimum gross annual income that amsterdreams requires is the value of the home divided by 10, so 80,000 euro. No bank is going to provide a mortgage of 800,000 euro to a customer with an income of “only” 80k (please mind the respectful quotes – that’s a lot of money!). What this means is that to qualify for a mortgage, you would need to bring in a lot of capital from a previous home you sold with a profit, a rich uncle, etcetera. Or you need to have a (much) bigger income than amsterdreams requires for the same home. |

So where did the rest of the returns go, that the mortgage users enjoyed? It went to the amsterdreams investors. The assumed 10% that the house prices rise every year in this example is enjoyed by owners of AMS tokens. If the price of AMS was 1,000 per token when this apartment was bought, those 800 tokens are now worth 2.15 million euro, a 268% increase over these 25 months. This growth potential is what fuels interest to invest in amsterdreams homes.

Conclusion

The gut feeling of our clever customer survey respondents was correct: you can get the biggest return on investment if you buy a home yourself. However, you need to be able to access that capital somehow and then you’ll only be able to enjoy your return once you sell your home.

Renting is, we’re sorry to be blunt, a complete waste of money. It isn’t even necessarily cheaper than rent to own with amsterdreams and you save up absolutely nothing. amsterdreams provides the same flexibility while still building your savings.

The amsterdreams way of living is enabled by the amsterdreams investors, whose small investments of maybe a few hundred to a few thousand dollars are pooled together to buy homes for our customers. The investors in turn enjoy returns as a consequence of the growing value of the Amsterdam market. Since all amsterdreams customers are also collecting AMS tokens through their monthly payments, they are investors themselves and enjoy the same relative return. Every customer is an investor! And every customer, every investor benefits.