TL;DR – the AMS tokens that you invest your money into to own a piece of Amsterdam housing is recorded on the secure blockchain. Cryptocurrencies also live on there and they’re notoriously up and down all the time. This article explains why AMS is more stable, by design.

What drives the value of something?

Have you ever considered why an item is worth as much as it is? Why does one pair of lady’s shoes cost 50 euro and a pair of Jimmy Choo 700? Are the Jimmy’s better quality? Probably. Do they last 14 times as long? Probably not. Were the materials to make them so much more expensive to justify the higher price? Not really.

These extreme luxury goods, but also priceless paintings, vintage cars and so on are excellent to illustrate this point: something is worth a certain value because people feel that it has that value. But that holds for everything, including cryptocurrency.

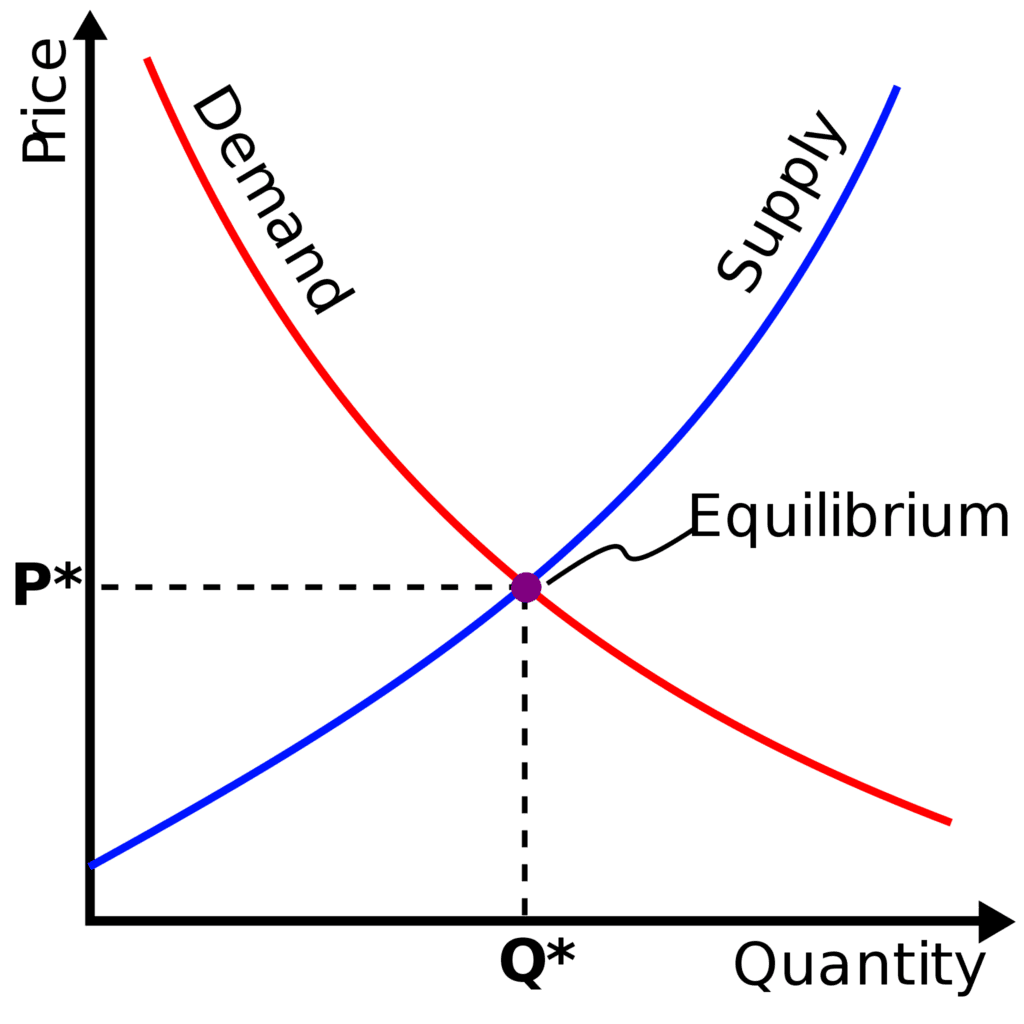

A cryptocoin like Ether or Bitcoin is the ultimate example of a Jimmy Choo shoe. It has a value even though it is not made of anything. You can’t even hold it in your hand. The supply of cryptocoins is limited, at any given time. If people want to buy them, demand increases. Basic economics then dictates that the price goes up. This price increase actually makes it interesting for people to buy the coins in the first place, so they can buy today and sell tomorrow at a profit. That drives demand and prices further up. And so on.

The problem with pure supply and demand

Cryptocurrency is purely supply-and-demand driven. Most coins have either a fixed supply (no new coins can be ‘minted’, ever) or some mechanism that actively maintains scarcity. Bitcoin, for instance is based on a mechanism that requires fast computers to solve a big math puzzle. This takes time and effort (electricity), which means the supply only increases very slowly. High demand, low supply means high prices.

There’s nothing wrong with this mechanism. In fact, contrary to popular belief, normal currency works roughly the same way. Once upon a time, a country’s currency was backed by a gold reserve that made it very stable: you could always change a dollar (say) for a certain amount of gold. But the gold standard offered governments too little control to steer the economy and it was abandoned in the Great Depression in the 1930s.

The problem occurs when demand itself is unstable. Sorry to sound like a boring high school textbook, but this is exactly what’s happening with cryptocurrency. Crypto is now seen by investors as something to invest in when traditional things are also in high demand.

Let’s say there is a lot of money in the economy. Everybody decides to buy Tesla shares. This drives the price of Tesla shares up so much, that people start to look for other things. After this cycle repeats, people turn to cryptocurrency.

When the amount of money in the market goes down, for example because interest is rising, then the investors back out of crypto just as quickly. And other than with the dollar, euro or yen, there is no Bitcoin Central Bank that buys or sells some coins itself to stabilize demand.

The irony is that even though Bitcoin was designed to be independent from the financial markets, its exchange rate follows the market very closely. That is where the money is coming from.

How amsterdreams AMS is different

Both AMS and a cryptocoin like Dogecoin live on the blockchain and share the same technical underpinnings. This led in our 2022 customer survey to the concern that AMS would be just as volatile as cryptocurrency. But the fact that a plane ticket and a concert ticket are both tickets does not mean they behave in the same way.

AMS uses blockchain technology because it is secure and traceable. The big difference is that AMS is backed by housing – much like the gold standard! Housing is to AMS what gold was for the US dollar until 1933. Here’s how that works. This example is obviously set after September 2022 when the AMS token is available:

- Let’s say that the value of AMS is 1,100 euro. That is not determined by supply and demand, but by a calculation made at amsterdreams of the value of the houses in our portfolio. That is described here.

- On amsterdreams.com, you can buy and sell tokens for 1,100 euro

- There will probably be other sites, like exchanges (e.g. Bitvavo, Uniswap) where AMS can be traded for Bitcoin, DAI, etcetera

- A large investor, who owns 500 AMS, decides to sell this large amount in one go on Uniswap for some reason

- Following the logic above, there is suddenly a huge supply of AMS on Uniswap: more AMS is being sold in a short time than people want to buy. So the price of AMS goes down.

- Through all of this, nothing has changed to the Amsterdam housing market. The houses in the amsterdreams portfolio still have the same value. The rate of AMS on amsterdreams.com is still 1,100 euro.

- The way a market works, people (and even computer algorithms) will realize that there is ‘cheap AMS’ available on Uniswap, which they will quickly buy, because they know they can still sell it for 1,100 euro.

- This new demand will drive the price up, until it touches 1,100 euro again. Above that, there is no point to buy AMS at an accelerated rate, which also means that the price will not continue to rise.

In other words, there is a stabilizing mechanism that prevents the price of AMS from becoming too low or too high. Too high is also not good, because that would create a bubble between the value of AMS and the actual value of the houses.

Why have open trading at all

We could have completely fixed the rate of AMS by preventing trading outside amsterdreams altogether. All the buying and selling would have to be done through amsterdreams.com. Technically, this would be very easy to do.

We took the deliberate choice to enable AMS to be traded outside amsterdreams. First of all, this is about trust. We don’t want to be the only place in the world where you can get your money back. We wouldn’t, but hypothetically we could do all sort of nasty things, like blocking buying and selling whenever it would suit our (hypothetical) nefarious purposes. We don’t want to have to say: trust us, we’ll be good. We want you to be independent of that.

The other reason is more technical. If our website is down for maintenance, or a rogue government blocks our IP address for some reason that made sense only to them, that should not be a problem for you. It’s your money, after all.

A word to the wise

We put this bit of text at the bottom of every article on investing. Not in fine print and not because we have to. We want the best for you and don’t want to get you in trouble because you bought into something we said.

Investment comes with risk. Past returns do not guarantee future successes. amsterdreams provides you to the best of our ability with information to judge the risk and compare it to other ways of saving or investing, but we are human and we can also be wrong. Things could happen that we did not foresee.

You could lose part or all of your investment. So don’t invest money that you cannot afford to lose.