TL;DR – we asked our customers and potential investors how we should shape amsterdreams. Over 300 people responded – thank you all! Overall, both the investment concept and renting to own with amsterdreams resonated well with the people who filled out the survey. Thanks to our customers’ feedback, we can make some changes to the way homes are paid for and how the lucky person who gets a home is selected.

Overall numbers and statistics

You’re going to see a lot of numbers and graphs in this article. To save you some time, we have highlighted some of the key figures for you:

- A total of 304 participants filled out either the investor or the customer survey

- The questionnaire was split into two parts: one for people looking to invest in AMS tokens and one for people who wish to live in Amsterdam, maybe with amsterdreams

- Most responses came from the United States (38%), Netherlands (34%) and the UK (23%)

- Almost all investors had put money in a savings account (86%), with just under half the people also investing in stocks on the stock market and in cryptocurrency (45 and 48% percent, respectively)

- Most people (61%) invested between 1,000 and 10,000 US dollars or Euro

- 27% of respondents to the customer survey currently live in Amsterdam

Next, let’s go into some of the interesting results. Some of the results made us rethink part of how we set up amsterdreams. We’ll come back to those in future articles. Don’t want to miss a thing? The newsletter or our Facebook page is an excellent way to make sure you stay up to date.

Customer preferences

Our customers, who will be living in amsterdreams homes, come first. But also for investors it’s important that there is a lot of interest in the homes. Let’s look at what you said.

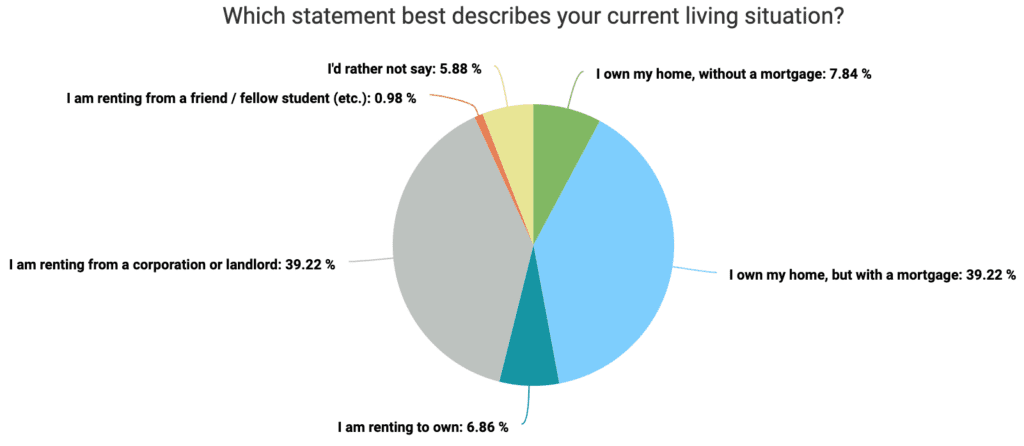

The largest group within our respondents own their home, about 48%. (We are more than a little envious of the 8% who own a home and are mortgage-free!). 7% are already renting to own (fantastic), but probably the biggest target audience for amsterdreams are the 40% of renters.

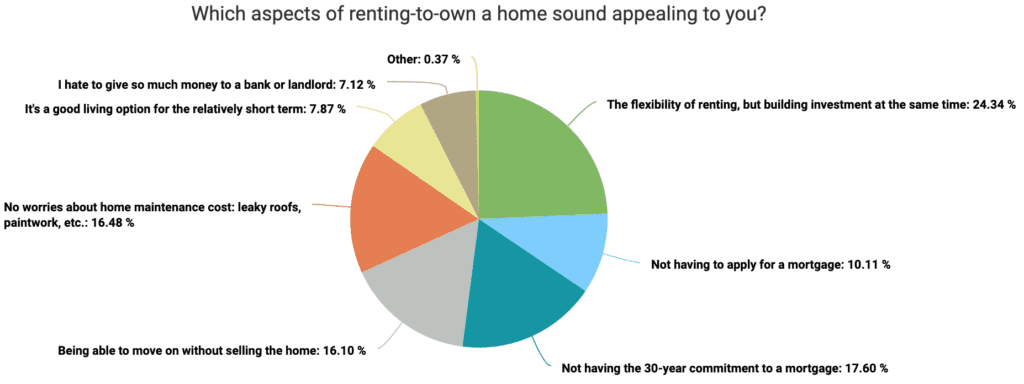

Next, we asked about the benefits of renting to own:

The combination of flexibility and building investment resonates very well. You can add the flexibility of being able to move without the hassle and financial risk of selling the home to that and come to more than 40% who like this benefit. But there are also 28% of respondents who did not like the commitments and application for a mortgage.

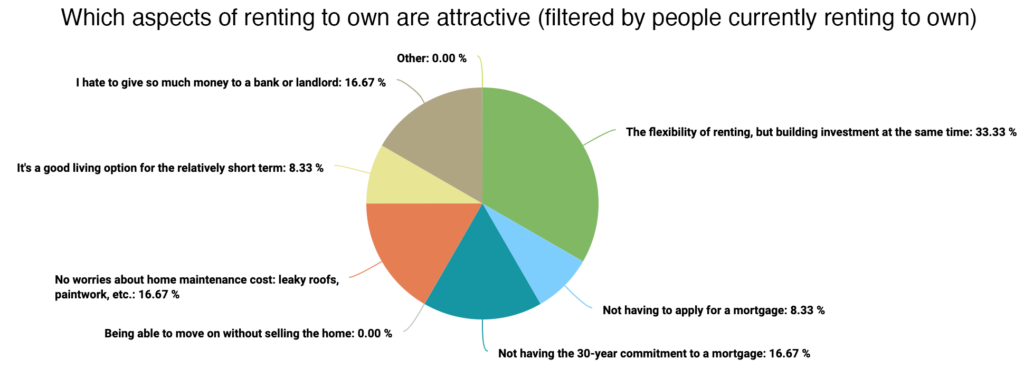

This picture doesn’t change significantly when we filter for people who are currently renting or who own their homes. What could be interesting, is to look at the people who are renting to own at the moment. They should know what the benefits are! Caution: this is a 7% subset of the respondents, so a small number of people. Let’s take a look but take the results with a pinch of salt.

Finally, we asked the prospective customers if they would take advantage of the fact that you could put extra savings into an amsterdreams home without incurring a penalty. For those unaware: a bank will make you pay a penalty if you pay them back to quickly, because they had wanted to charge you more interest!

85% of respondents said they would put more money in if they could and 15% would only pay the required minimum. The reason to spend more was split down the middle: about half the people who would put in more (48%) said they would do it to own their home earlier and 52% would primarily do it to take advantage of the growing value of the housing market.

Investor responses

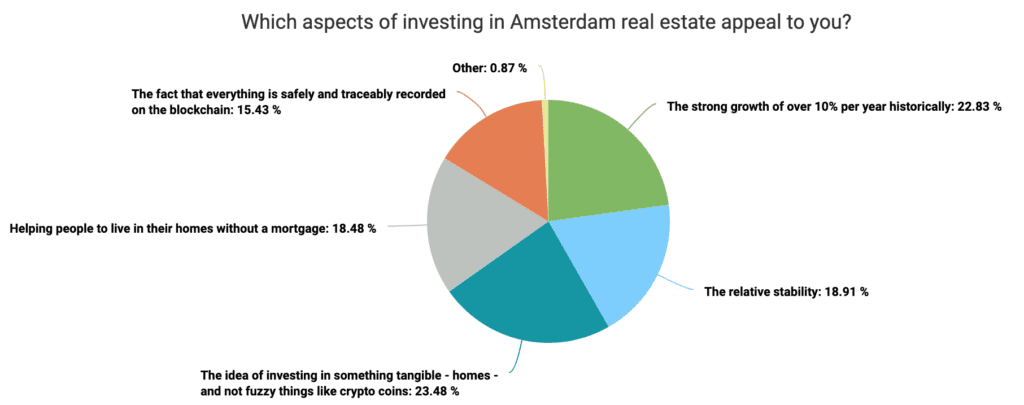

We also asked potential investors what they would like about investing in amsterdreams homes.

There was a very nice spread over the various benefits. The large sharing argument – 18% answered that they would do it to help people live in nice homes without a mortgage – shows that our respondents care where they invest their money. Growth and stability are also recognized as benefits, with the largest group of 23% responses liking the fact that there are homes under the investment and not merely supply and demand like with unbacked crypto coins.

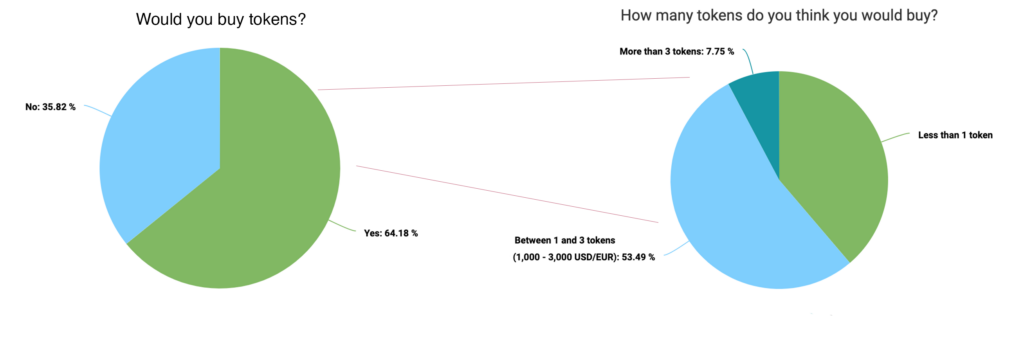

Based on the recognition of these benefits, it is not surprising that almost two thirds of respondents said they would buy some AMS tokens when they come out. Of those, the majority (53%) expects that they will buy between 1 and 3 tokens.

Speaking of buying, we asked respondents if they would be inclined to buy more if there was an ‘early bird’ discount of 10% before September 1. The response was very positive:

- 20% of people who originally would not buy, now would

- 63% of people who are originally planning to buy AMS tokens, will now buy more

Based on this feedback, we decided to do it! We have to work out the exact how, but we will definitely make tokens available early at a discounted rate.

There was enthusiasm for an early-bird offer to buy AMS tokens at a reduced rate.

So we decided to go ahead and do it

Long term, most people expect to invest in 5 to 6 AMS tokens, with almost 10% indicating that they could get 10 tokens or more.

Concerns and homework for amsterdreams

We also asked which concerns our customers and investors have, so we know where to focus on improving our service or taking away those concerns. In other words, we gave ourselves some homework!

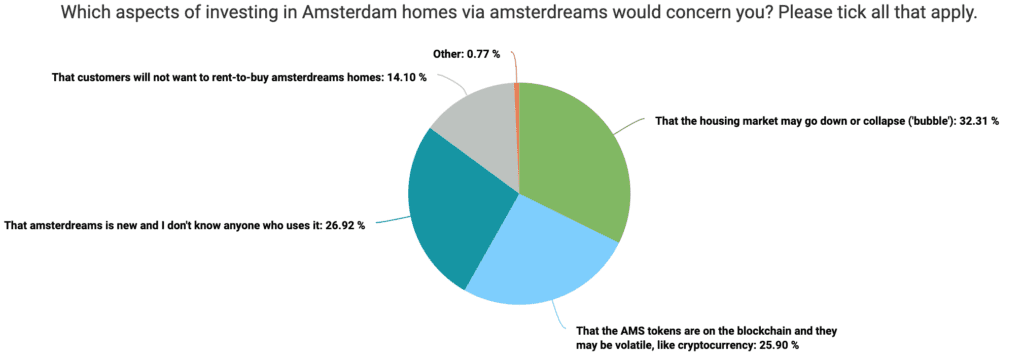

Common to investors and customers, there is a concern about the ‘newness’ of amsterdreams. By coincidence, in each group, about 26-27% of respondents said that one of the concerns they had was that amsterdreams was new and/or they didn’t know anyone who used it.

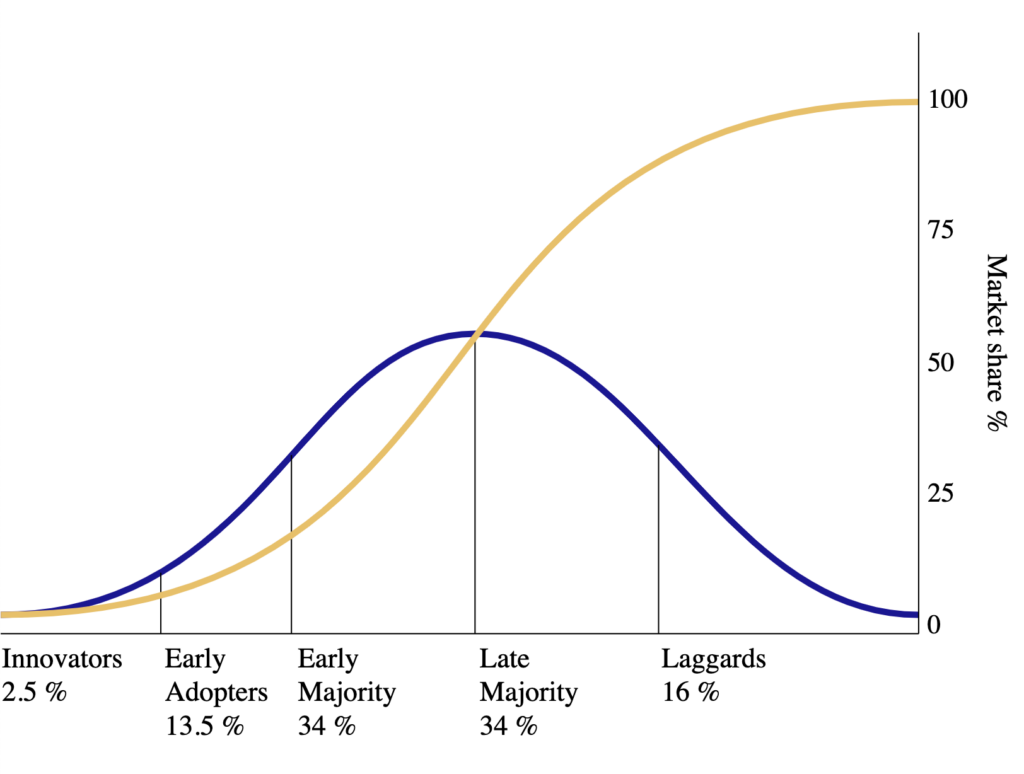

The newness concern is in the dark green segments. This is actually really low! There is a very commonly used theory for the adoption of new innovations, that is the work of a Professor of Communication Studies, Everett Rogers. He published Diffusion of Innovations in 1962 (!) and the theory has been applied and proven countless times since. Professor Rogers distributes the market into various segments, from Innovators and Early Adopters to Laggards, people who only adopt when there is no longer an alternative: for example, who only got a smartphone when it became the only type of mobile phone available to buy.

The Early Majority and all segments to the right of it are somewhat to very averse to innovations, while the innovators and early adopters jump on it. That means that it is normal for 84% of the market to have some degree of ‘newness concern’. Among our current website visitors and survey respondents, it’s only 27%, which can only mean that you, reader, are very likely to be an innovative individual!

Customer monthly payment

Some of the investors, 14%, had the concern that customers would not want to live in amsterdreams homes. That was the most important thing we wanted to check with the investor survey. Based on the recognition of benefits above and some of the free-text responses in that survey, we are now very confident that people are excited about the possibility of amsterdreams rent to own! 🥳

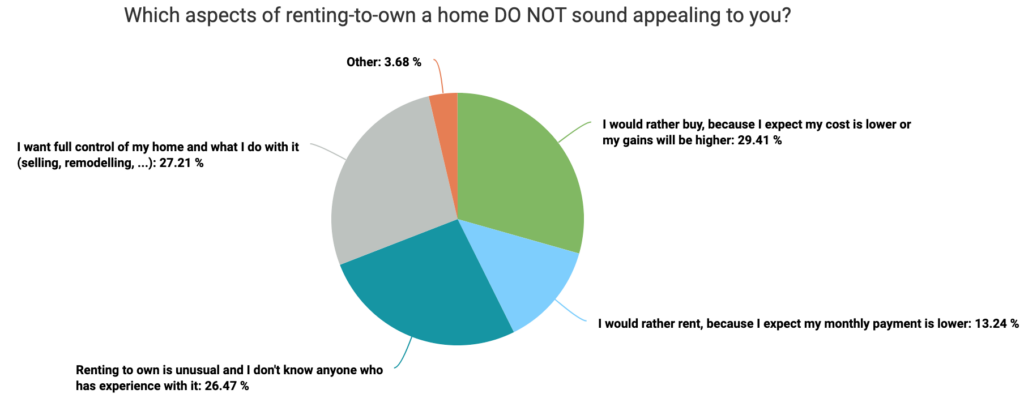

Potential customers did voice some concerns about the monthly burden: that their cost would be lower or gains higher when buying (29%) or that their monthly payments would be lower when renting (13%). We will do an article that compares the three main ways to live in an Amsterdam home soon. We’re confident that the amsterdreams way will be competitive, but we need to prove it to those 29+13=42% of respondents.

As part of the open text responses in the customer survey, we also noticed some concerns about the monthly payment that varies with the market. As the value of AMS rises, you invest more and your investment grows – great! – but in normal currency, you also have to put in more money to keep your investment growing at the same speed towards owning your home. That may not appeal to everyone’s situation. We think we have a solution to the problem, so watch this space! It’s another change for the better that we will make, based on our customers’ feedback. Did we say ‘thank you’ already? 🙏🏻

AMS and housing market volatility

A large part of the investors voiced concerns about the housing market itself (32%) or the negative association with AMS being on the blockchain and thereby as volatile as, for instance, Bitcoin. We even joked about the ups and downs of cryptocurrency ourselves, in this Instagram reel. It’s clear that we have to show why AMS is different, because it is backed by the Amsterdam housing market, while most cryptocurrencies are backed by nothing tangible. This is the subject of a future article. [EDIT – that article now exists! Read here why AMS is more stable by design than cryptocurrencies]

The Amsterdam housing market itself is the backbone of amsterdreams. It is very natural to be concerned about it. There are no guarantees, but historic data is inspiring and shows that the market is strongly growing and resilient, even in light of the 2008 financial crisis, for example. We already wrote an article about that, here.

Home selection process

We really want amsterdreams to be fair. This is why we will have a random home selection process: if a customer passes the eligibility test (income, resident status), she has as much chance as anyone else. The size of her wallet, skin colour, where she was born: nothing makes any difference.

We got a lot of positive responses to this. Some quotes:

- “Leveling the playing field is fairer overall”

- “It is a fair way of giving everyone the same chance. This way, the rent won’t go up through overbidders.”

- “I like it because I don’t like discrimination”

At the same time, we also received some concerns. Perhaps the two respondents who voiced it best was one person who said “I get it, but it would feel like placing your fate in the hands of someone else” and the respondent who described it as “I’m not sure about that, because personally I never win anything significant”.

We hear you. While we don’t want to compromise the fair selection process, we do want to make it feel less like a lottery. We never win anything either 😏 We have some ideas, but need some time to work it out. Watch this space, we’re going back to the drawing board!

Next steps

The amsterdreams team got a lot of useful information from the survey. We know this article was very long, but we wanted to share all our findings with you and what we’re going to do with them. Just like we say: it’s your money, it’s your information.

The next things will certainly come out of this survey:

- An overview of monthly burden and overall payments for buying a home, renting and living via amsterdreams

- Making a change to the monthly payments that you make to amsterdreams as a customer, to accommodate everyone’s needs

- A clearer explanation of why the AMS tokens will not be as volatile as cryptocurrency

- A better home selection process that feels less like a lottery

In parallel, we’re already working on the amsterdreams roadmap: when you can expect what? The best way to keep up with these developments is by subscribing to our newsletter or follow our Facebook page.

Thanks again for giving us direction! – the amsterdreams team