TL;DR – In early 2022, the world went into economic stormy weather. Inflation was already up as the economy tried to restart after the corona pandemic, and then war broke out. Will this affect the Amsterdam housing market? Nobody knows. But looking at the last crisis, in 2008, makes it look like the Amsterdam market will do better than most.

One driver of high housing prices is that people have access to money. If a bank is willing to loan more money and interest is low, buyers are willing to bid more. And they have to if there is a lot of demand for only a few houses. That sums up the Amsterdam housing market in the past decade pretty well.

But what if interest goes up? Does that automatically mean that prices will go down? The scarcity in the market is still the same: there are not suddenly more houses. In fact, if home owners cannot move out of their home because they can’t afford the mortgage on the next home, perhaps even fewer homes will come into the market.

If we’re honest, nobody knows. People who claim they know have an agenda: a selling real estate agent might say that you should accept the low bid on your house because the market will get worse. A buying agent may tell you that you should bid high while you still can. And so on.

What we can do, is take a look at what happened the last time there was an economic crisis. In 2008, the financial system almost collapsed because banks that had taken really big risks started to fold one by one. This was a crisis in the mortgage business, so right in the heart of housing! If we take a look at how the market recovered from that, we should have a decent idea how it should come out this time.

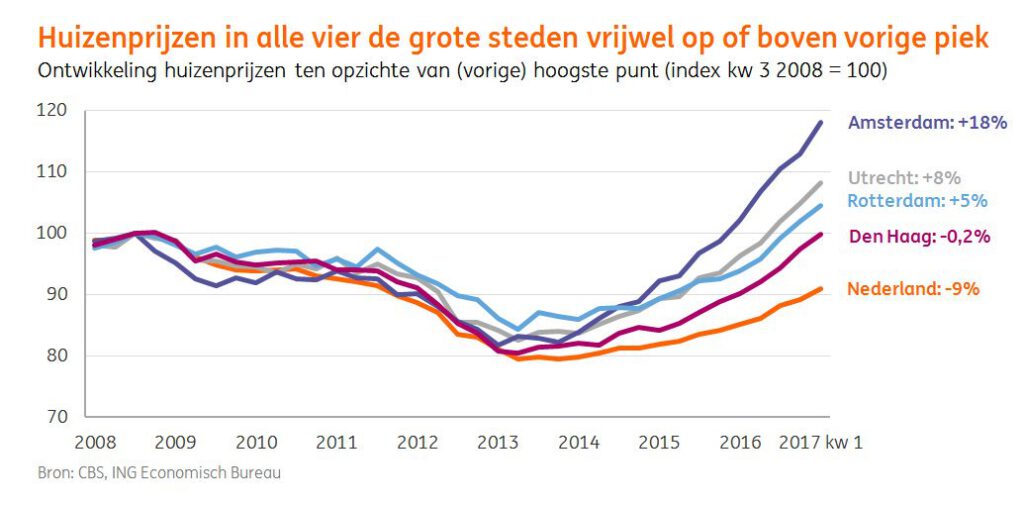

This picture was taken from a 2017 Tweet by Dutch bank ING, which in turn was based on data of the Dutch government. What they did was track the house prices for Netherlands and its four largest cities from just before to almost a decade after the crisis.

There are several interesting things in this graph if you’re an economy geek 🤓 For the rest of us, though, there are two facts that stand out:

- The actual decline of the housing market – that was definitely there in the 2008 credit crisis! – is actually a very slow and gradual process that took about five years. It is typical for real estate to evolve very slowly, which is also what gives the AMS tokens their stability. Other than with stocks or crypto, there is no reason for immediate panic.

- Amsterdam recovered best, ending up 18% over the previous all-time high of 2008. The growth trend that started in 2013 has really endured ever since.

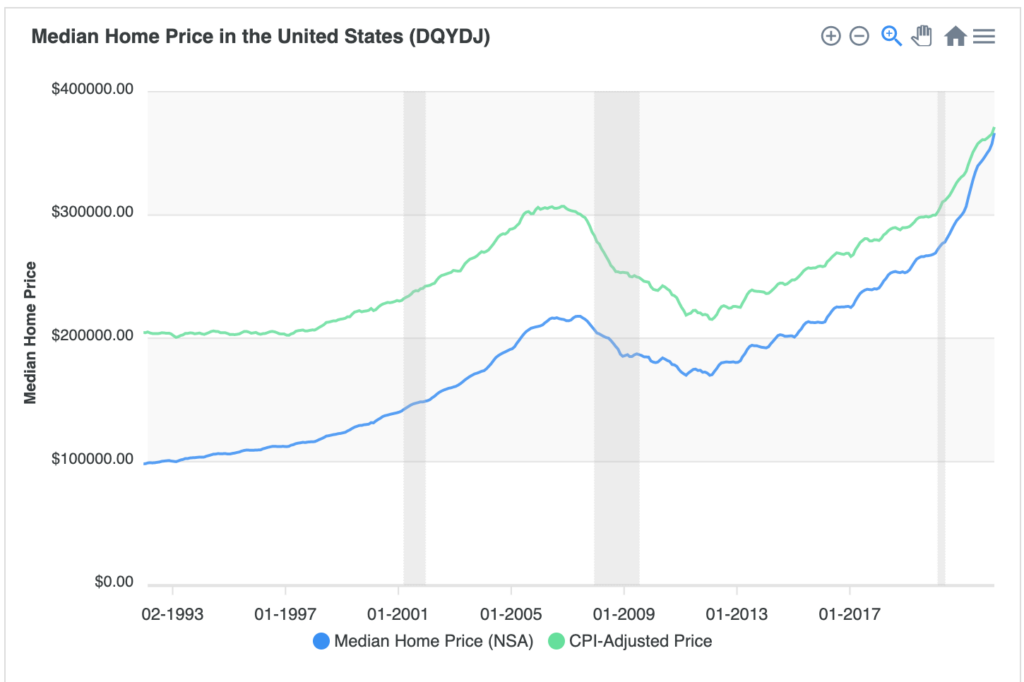

One more graph 🤓🤓🤓 This one is from the U.S. market and includes the same period of 2008-2017, but also some years before.

At first glance, the right part of the graph shows the same type of banking crisis dip and then recovery. Over 30 years, the U.S. average house prices have increased by about a factor of 3.5, or 1.75 when corrected for inflation (the Americans call this CPI, Consumer Price Index).

But now look at the grey bars. They indicate the crises that we’ve had. The one above the year “2001” was of course the crisis caused by the 9/11 attacks. Quite a significant event! Airlines and insurance companies nearly went out of business, dragging aircraft manufacturers and many supplying business down with them. There was also a war, on terror.

Remarkably though…the U.S. house prices were not affected! They kept on rising at the same pace they had been doing. So while the banking crisis was, literally, a shock to the system, 9/11 did not affect housing that much at all. The same happened (well, didn’t happen) in The Netherlands and Amsterdam.

As predicted, no answer. We’re not trying to sell you anything 😉 The only thing we’ve shown is that the housing market is quite robust to crises. If there is a crisis, like there was in the heart of housing when the subprime mortgage bubble burst, then Amsterdam – historically – is well positioned to come out on top!

A word to the wise

We put this bit of text at the bottom of every article on investing. Not in fine print and not because we have to. We want the best for you and don’t want to get you in trouble because you bought into something we said.

Investment comes with risk. Past returns do not guarantee future successes. amsterdreams provides you to the best of our ability with information to judge the risk and compare it to other ways of saving or investing, but we are human and we can also be wrong. Things could happen that we did not foresee.

You could lose part or all of your investment. So don’t invest money that you cannot afford to lose.