TL;DR – if you don’t like a long read and discover all the hilarious jokes and puns we hid in the text, then what you need to know from this article is this. You can get an amsterdreams home if your annual income before tax is at least the value of the home divided by 10 and you are an official resident of The Netherlands.

Finding your home

Once the amsterdreams home website opens in the fall of 2022, you can find your home there. Depending on your preferences, this could be the hardest part or the easiest. For the sake of this article, we’re going to assume that you find a place that you totally fall in love with.

The house will have a price on it, in AMS tokens. One AMS token at introduction will have a value of 1,000 euro and will increase from there. More on that in another article. A gorgeous two-bedroom apartment may cost, say, 500 AMS. Already looks a lot friendlier than ‘half a million euro’, wouldn’t you say?

Can I afford it?

amsterdreams tries to keep the answer to that question really, really simple. You divide the price of the apartment by 10 and compare it to your yearly income before tax. If your income is higher, you can afford it. If not, sorry, you’ll have to have a chat with your boss first. In the case of the 500 AMS apartment at 1,000 euro per AMS, your gross income per year would need to be at least 50,000 euro.

You’re probably wondering by now: why 10? That is because amsterdreams spreads the value of the home out over 30 years, or 360 months. The saving you put in, before cost like taxes and the amsterdreams fee, is therefore 1/360th of the value of your home. To protect yourself from your own enthusiasm to get your dream home even if it’s perhaps a bit pricey, we ensure that your monthly income is at least three times that. We will leave it as a fun math exercise to work out that 3/360th of the price of the home requires your annual income to be the price / 10. But you can also just trust us on that one.

How much do I pay per month?

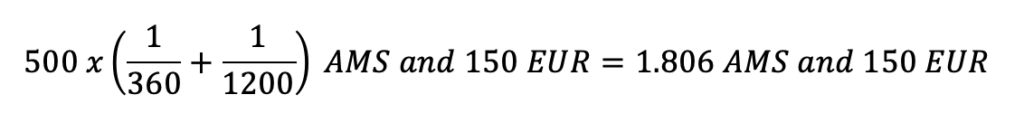

If you’re still reading, you must be pretty good with numbers. So let’s have some more. Your monthly payment consists of three components. If your home costs X AMS (so X is 500 in the example above), then:

- Your saving, X / 360

- The amsterdreams fee, which is X / 1200

- Service cost and taxes. These vary from home to home: for example, apartments with a lift tend to have higher service cost than those without. The tax (real estate tax “onroerende zaakbelasting”) is higher for more expensive homes. And so on.

Quick calculators will have worked out that the amsterdreams fee is 1% per year. That is what we charge to keep amsterdreams running.

The service cost and taxes are the same amounts you would pay if you owned the home. amsterdreams simply passes these on to the government, the owners’ association, and so forth.

To complete the example of the 500 AMS apartment, let’s assume the sum of these taxes and cost is about 150 EUR per month, which is not an unreasonable amount for such a home. You would then pay

per month. At 1,000 EUR per AMS, this is 1.956 EUR per month. As the value of AMS goes up, so will the amount you pay in euro – but remember that the amount you saved also increases by this same amount! The saved amount per month, by the way, is 1.389 AMS, by the way, or 77% of what you put in every month.

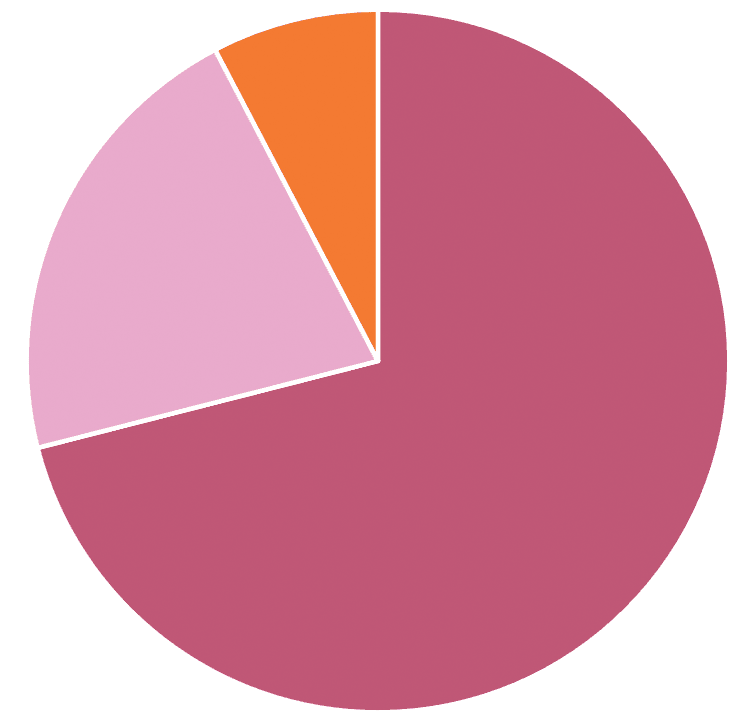

Cost breakdown

Savings

Fees

Taxes and service cost

Think about these numbers for a minute. Over three quarters of what you put into your home every month is yours. And will always be yours. What is that with renting? Zero. Renting: 0%. amsterdreams: 77%.

With amsterdreams, 77% of the money you put in every month goes into your savings. With renting, that percentage is 0%.

Can I save more per month? Is there a penalty if I do? Can I take money back out?

Yes, no and yes. It’s your money and (unlike a bank with a mortgage) amsterdreams does not penalize you if you want to save more or take some of your investment back to wherever life takes you. We look forward to explaining more about this in a future article.

When is the home fully mine?

We should have made this a quiz. You’re smart, you probably figured it out by now. You pay your home in 360 installments, so if you keep going at that rate, the home is yours after 30 years.

But we don’t expect you to take three decades to do it. You can, it’s fine with us. But more likely you will put in more money at some point, from a bonus or an inheritance. You may get a normal mortgage and pay the remaining balance. Like we said before, no extra fees or penalties. We want the home to be yours. Whenever you’re ready.