TL;DR – if you’re in a rush, here’s the long and short of it. This article explains why house prices in Amsterdam have risen by as much as 18% per year in recent years. And how you can benefit from this increase.

Some basic economics (made unboring)

Why is investing in Amsterdam real estate such a good investment? What it really comes down to is a high school economy lesson: supply and demand. Living space in Amsterdam is continuously in high demand because its popular. Whether for work, study, the arts, as a central location for travel or because it’s been a tolerant place to everyone irrespective of politics or religion. Amsterdam is simply a nice place to be.

The demand is then obvious. The supply of living space in Amsterdam, however, is limited and only increases very slowly. For various political and environmental reasons, new developments have been few in the past few decades. But there is something else that provides scarcity: the ‘real’ Amsterdam that most people want to live in if they have the choice, is roughly within the ring that is the A10 motorway – and then in particular the part south of the IJ waterway (more or less pronounced as ‘eye’).

The part of Amsterdam that most people want to live in is limited in size and will not grow

That piece of land is limited and will not grow. What is built there is the Amsterdam you know from postcards: canals, houses with the typical ‘staircase’ facades from the 17th and 18th centuries. The city council is not going to tear those down and replace them with Hong Kong-style skyscrapers. The scarcity of housing, in other words, is here to stay.

The final component that has driven up real estate prices in Amsterdam, but also in Netherlands and the world in general, is an extremely low interest rate for several years. A lot of people had access to more capital to buy a house than ever before. And if people can afford something, and they want it badly enough, they will pay for it.

“You must be crazy”

Tell an average person – one who doesn’t live in Amsterdam herself, that is – that you’re looking for housing in the city and they may question your sanity. The arguments they will use is that you can buy a much bigger house for the same money in the country or in a smaller city. While that is true, this rational approach conveniently ignores all the reasons to want to live in Amsterdam.

There are two counter arguments to the insanity that has seemingly befallen the inhabitants of Amsterdam. First of all, the high demand suggests that there is then at least a large number of people who feel this way. They must be on to something.

The more rational argument is that a house in Amsterdam is not just an expense, you can see it as an investment. And that is exactly how amsterdreams sees it.

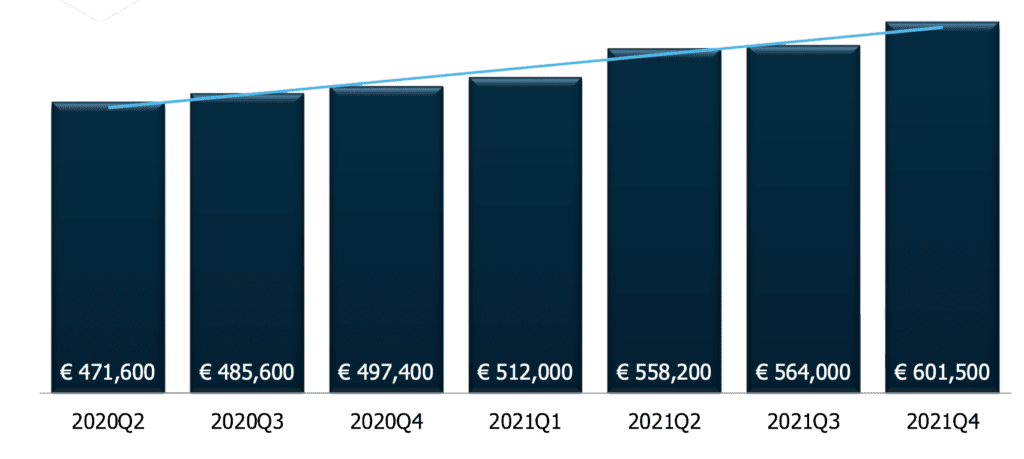

In 18 months, the average house price went up by 27.5%, or 18% on an annual basis. It is also quite steady, especially if you consider the COVID-19 pandemic was underway during most of this period. This kind of return does not come easily on the stock market, let alone with a savings account.

In recent years, the value of homes of Amsterdam has increased by 18% per year. That kind of return is hard to achieve with many types of investment.

This is why investing with amsterdreams is such a good idea

You don’t have to actually buy real estate in Amsterdam and rent it out to get a good return on your investment. Sure, if you can collect rent then your return is even bigger, but so is your risk and the amount of capital and work you have to put in. By buying a piece of Amsterdam, you too can benefit from the value increase of the housing market.

A word to the wise

We put this bit of text at the bottom of every article on investing. Not in fine print and not because we have to. We want the best for you and don’t want to get you in trouble because you bought into something we said.

Investment comes with risk. Past returns do not guarantee future successes. amsterdreams provides you to the best of our ability with information to judge the risk and compare it to other ways of saving or investing, but we are human and we can also be wrong. Things could happen that we did not foresee.

You could lose part or all of your investment. So don’t invest money that you cannot afford to lose.